Gold Smart Credit

Features and Fees

Credit card Gold Smart Credit provides comfort, flexibility and safety wherever used. Use your card actively when buying goods and services at merchant outlets, or on the Internet, ensure your traveling comfort and shop with pleasure.

With Gold Smart Credit take advantage of special offers providing negotiation and discount offers in prestigious hotels and resorts as well as other boutique offers.

With Gold Smart Credit take advantage of special offers providing negotiation and discount offers in prestigious hotels and resorts as well as other boutique offers.

- Exclusive seasonal offers from MasterCard Worldwide

- Special business proposals and offers by MasterCard Premium and General Terms of package services

Credit limit

Icon5 000 BGN to 30 000 BGN

Currency

IconBGN

Time limit for issuing

IconUp to 5 working days

Interest rate

Icon1,49% per month

Annual expense ratio

Icon*Example: 24.07 % with a repayment term of 12 months, an annual fee of 100 BGN/ 51.13 EUR, utilized credit limit of 5000 BGN, a monthly payment of 3 % (150 BGN/ 76.69 EUR) of the amount of disbursed limit, monthly interest rate 1.49 % and total due amount at end of period 5 603.84 BGN. 2 865.20 EUR.

Card validity

Icon4 years

Annual fee

Icon100 BGN/ 51.13 EUR or No annual fee when the card is included in Plan Max

Deferral of payment

IconIn Bulbank Mobile or Bulbank Online only in the month in which it was booked.

Minimum repayment amount

Icon3% from the allowed loan limit

Grace period

IconUp to 45 days for purchases at POS terminals

Due date

IconFrom the 1st through the 15th day of the month

Lock/ Unlock a card

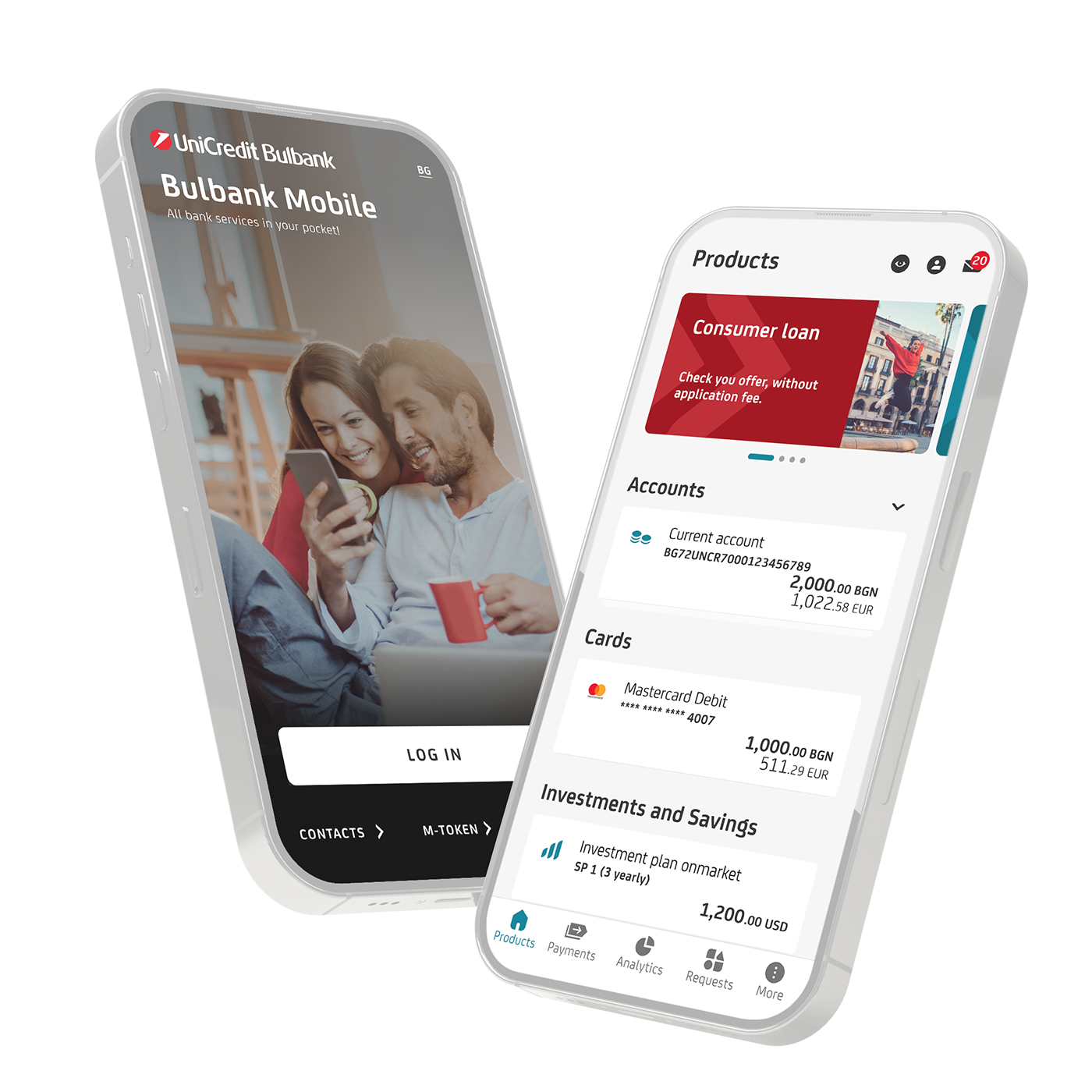

IconYou manage the status of your card for free on your own via Bulbank Mobile

Secure payments to online merchants

IconWith “Dynamic Password”

No PIN entry for amounts up to BGN 100

IconIn the country

Liabilities repayment

Icon- Direct debit - automatic repayment of a minimum repayment amount and all credit card liabilities from other bank accounts

- Mobile or online banking - repayment of a minimum repayment amount or larger amounts directly to the card account

- Installments at ATM - with cash deposit to a credit card account

- At cashier in the bank branch to a credit card account

24/7 customer service center

IconIn emergency situations or when you need to check your card balance.

Statements and notifications

Icon- Free of charge monthly statement via e-mail and available on Bulbank Mobile

- Free of charge SMS reminder and e-mail with information about due amount

View the full Tariff, as well as the General terms and conditions.

When making a transaction abroad with a bank card on a real or a virtual POS device in a currency different from the card one, the sum of the transaction is converted to a sum of the settlement in the exchange rate, defined by the International card organisations, applied on the settlement day.

UniCredit Bulbank books the transaction to the customer’s account according to the official FX rate that the bank applies on the transaction accounting (it may be different from the day of the payment sending). The settlement currency is EUR.

UniCredit Bulbank doesn’t apply any additional commissions at the currency conversion on the transactions with bank cards.

Delivery and activation

You can choose how to receive and activate your premium credit card Gold Smart Credit

Receive the card at a bank branch and activate at an ATM*

- Prepare your PIN envelope and insert the card into the ATM.

- Select the "Other Services" menu.

- Select "PIN Management", then "PIN Change".

- Enter your original PIN from the envelope.

- Enter and confirm your new PIN.

- Remember your new PIN and destroy the envelope.

- Done! Your card is now active.

*You can activate it yourself by changing your original PIN at a UniCredit Bulbank ATM or any other ATM with the BORICA AD logo.

Getting a card at an address and activation with an electronic PIN

- Log in to Bulbank Mobile.

- Find the inactive card in grey and compare the last 4 digits.

- Select the "Activate card" option.

- Enter the individual verification code from the cover letter.

- Remember the PIN for your card displayed on the screen.

- Done! Your card is now

Application

Gold Smart Credit is accepted at ATMs, POS terminals, online and anywhere Mastercard payments are accepted.

- Pay contactless quickly, easily and securely in one swipe without entering a PIN for purchases up to BGN 100 at merchants in the country marked with the contactless payment symbol.

- Use the card to book car rentals, airline tickets and hotels.

- Pay for a variety of goods and services at POS terminals or online at home and abroad with a payment deferral functionality for purchases exceeding BGN 50 in installments or their currency equivalent

- Pay bills and services from an ATM in Bulgaria via the B-Pay system.

- Change your PIN on ATM in Bulgaria.

- Check available balance at ATMs and check your last five ATM transactions in Bulgaria.

- Pay monthly bills for electricity, heating, telephone and other services on the Internet via the ePay.bg system (the operation is possible after a one-time registration at an ATM).

- For contactless payments abroad, the payment value below which no PIN is required varies and is determined by the bank servicing the terminal and the international card organisations (ICOs).

- In Europe, for example, the average limit for a payment without entering a PIN is €50.

How to Apply

Documents required and conditions:

- Minimum net monthly income BGN 1,000

- Client’s ID card

- Income other than employment relationship or without income transfer to bank account evidence

- Foreigners should a resident permit for Bulgaria

Apply for your Mastercard Gold

Online

Complete the online application form and one of our consultants will contact you.

At a bank branch

Apply for the card in any bank branch.

Questions and answers

When you defer a payment, you can select one of the following periods: 3, 6, 9, 10, 12, 18, 24, 36 months.

You can defer payments made with Gold Smart Credit exceeding BGN 50.

The transactions that cannot be deferred are:

- Cash withdrawal at an ATM

- Cash back

- Betting in physical locations or online

- Money transfers to digital wallets of fintech companies

- Payments in stores for hunting and fishing equipment

Travel and Accident Assistance Insurance is provided as a gift to cardholders of high-end debit and credit cards.

It provides over 20 insurance coverages worldwide. The insurance cover is activated by purchasing a travel package or part of it (e.g. air ticket, hotel reservation, car rental) or any other service related to the trip using the insured card in the territory of the Republic of Bulgaria or by using the card at an ATM or POS terminal abroad during the travel period.

The dynamic password for online payment is a unique password for each payment, which the client receives via Bulbank Mobile during the payment process online with a merchant participating in the secure payment programmes VISA Secure and Mastercard ID Check.

The service is free of charge and is available to all cardholders of debit and credit cards for individuals or legal entities issued by the Bank with the logo of Mastercard, Visa, Visa Electron and VPAY.

When you request your card for issuing you can choose delivery to an address convenient for you (residential address, work address, etc.)

Security tips

Take care of your financial security by following a few simple rules when using your card.

Additional Card Services

Other credit card offers