Travel Tips

Check the coverage

Iconof your cards – international, local or Europe only.

When traveling abroad

Iconwe recommend you to have at least 2 different types of cards, e.g. Visa and MasterCard, debit and credit.

At least one week before your trip

Iconcheck the validity of your cards and try to remember their PINs. If your card is expiring or you have forgotten your PIN, you will be able to promptly renew it.

Check your account balance

IconAllocate the account funds according to your needs

Check the transaction

Iconlimits when using your card abroad.

Check the transaction fees

Iconfor payment at POS and cash withdrawal from ATM in order to decide which card is more convenient to use.

If you use a credit card

Iconmost probably you have an insurance. Check its coverage and how to activate it.

Write down the phones

Iconof the Customer Contact Center. If you need assistance, the bank is available 24/7.

Do not store your PIN

Icontogether with the card, on paper or another medium, and do not leave it unattended at public places.

Before entering your PIN

Iconcheck whether the amount shown on the display of the device is correct.

Upon completion of transaction

Icondo not forget to take your card and receipt from the POS terminal, as well as any additional invoices or documents issued by the merchant. You may need them later.

If you find that your payment was duplicated

Iconor you were overcharged or undercharged and you are still on site, notify the merchant immediately. If you do not receive assistance from him, contact the bank.

If during withdrawal the ATM holds your card

Iconcontact the terminal servicing bank and check the conditions for its return. If the bank has no such practice, you should block your card by calling the Customer Contact Center.

If your card gets lost or stolen

Iconimmediately call the 24/7 Customer Contact Center to have your card promptly blocked.

Carefully follow the steps

Iconupon ATM withdrawal and read the messages on the screen. You may be prompted to make a donation or to be given an option for cash withdrawal in a different currency

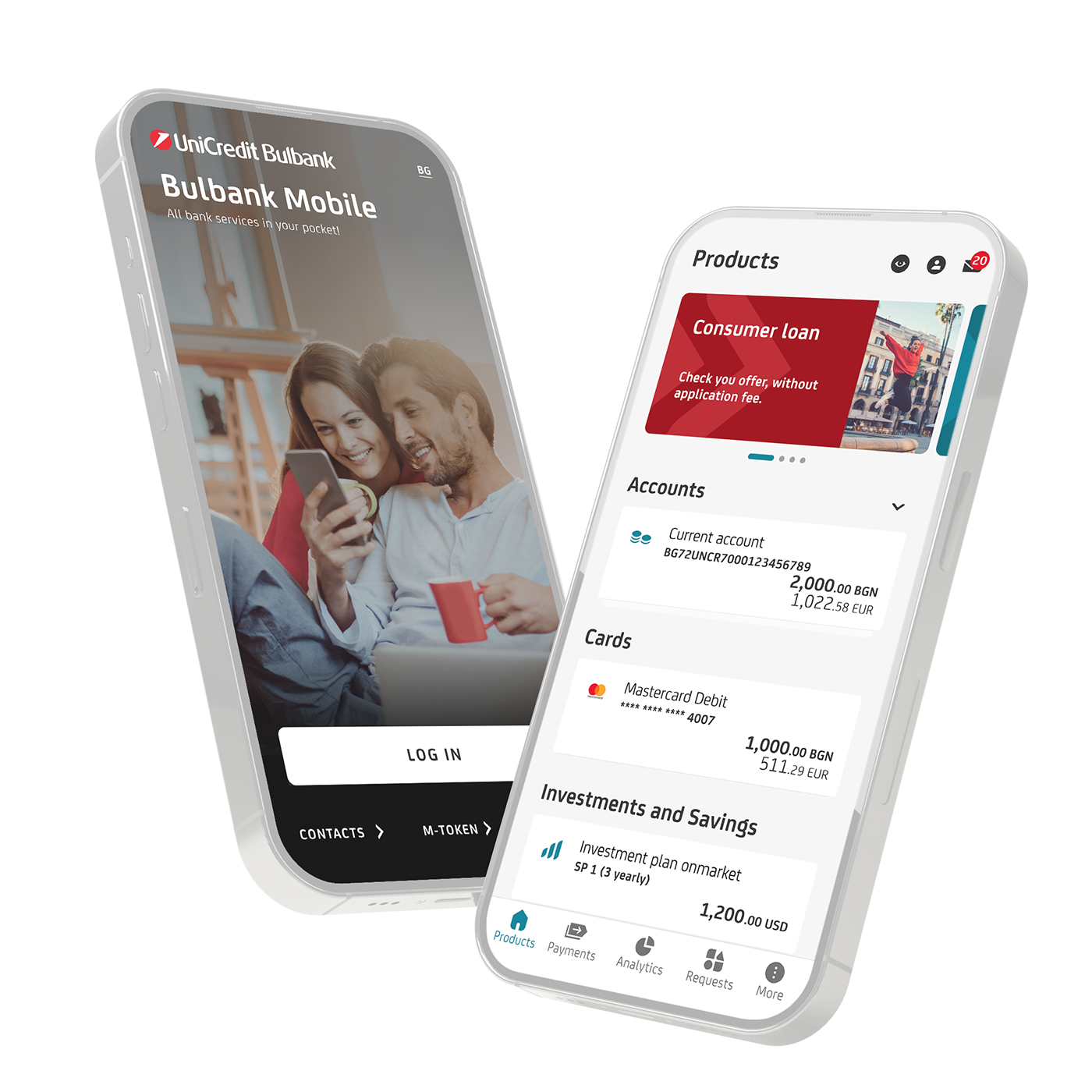

Control and monitor remotely

Iconyour account transactions and balances through the Online banking or Mobile banking.

For your piece of mind

Iconuse additional services, such as:

- SMS notification, whereby you will receive a notice for each transaction with your card

- Secure payment password, which protects your online payments