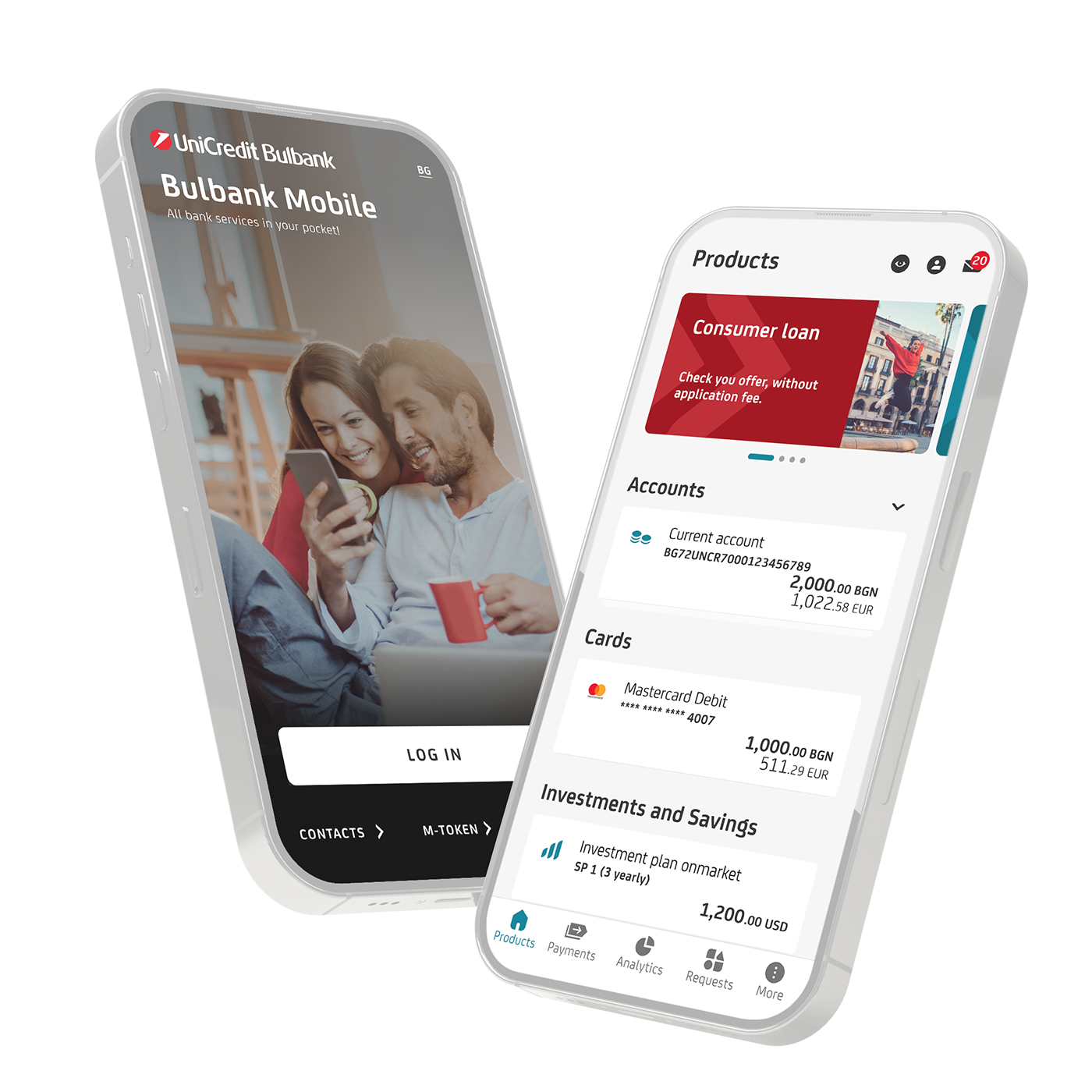

Debit Cards

Debit Card Mastercard

|

BGN, EUR and USD

Currency

|

6 years

Validity of the card

|

5 working days for standard orders

Time limit for issuing

|

- Contactless payment for daily purchases with no requirement to enter PIN for card purchases up to BGN 100 in the country

- Payment for goods and services no fee when paying at a POS device.

Debit Card Mastercard Gold

|

BGN, EUR, USD

Currency

|

6 years

Validity of the card

|

Up to 5 working days

Time limit for issuing

|

- Priority Pass - 4 free access to business lounges at over 1,700 airports in 600 cities and 145 countries

- Free insurance "Travel and accident assistance

Debit Mastercard Youngsters

|

No card fee

Monthly service fee

|

No fee

Issuing

|

18 to 25 years

Suitable for

|

- Fast and easy contactless payment of everyday purchases

- An option to manage the card via Bulbank Mobile

Debit Mastercard Teens

|

No card fee

Monthly service fee

Help Icon

tooltip

|

No fee

Issuing

|

14 to 18 years

Suitable for

|

- Possibility for exercising control over the expenses by the parent

- Fast and easy contactless payment of everyday purchases

Debit Mastercard Kids

|

No card fee

Monthly service fee

|

No fee

Issuing

|

6 to 14 years

Suitable for

|

- Possibility for exercising control over the expenses by the parent

- Fast and easy contactless payment of everyday purchases

Debit Card VISA Gold

|

No fee

Issuing

|

BGN, EUR and USD

Currency

|

6 years

Validity of the card

|

- Contactless payment for daily purchases with no requirement to enter PIN for card purchases up to BGN 100 in the country

- Preferential access to the business lounge “Aspire” at Sofia airport for cardholder and one attendant and with favourable prices at Vienna airport.