Bank Cards

UniCredit Shopping Card

UniCredit Shopping Card is an international contactless credit card with a deferral functionality for installment purchases.

Credit Cards

Operate with your funds 24/7 anywhere in the World. A convenient way to pay on POS terminals, maintenance of utilities and other regular payments.

Promotions

Promotional offers for bank cards.

Additional Card Services

Secure yourself an online shopping security by using a Virtual PIN, receiving SMS notifications for payments, or activating an additional insurance.

Security Tips

Learn how to stay safe when using the ATM and your credit and debit cards. Read each tip to learn more.

I activate my card myself

Activate your bank card yourself by changing your PIN code at an ATM of UniCredit Bulbank or an ATM with the logo of BORICA AD.

It's simple to get my card delivered to my address

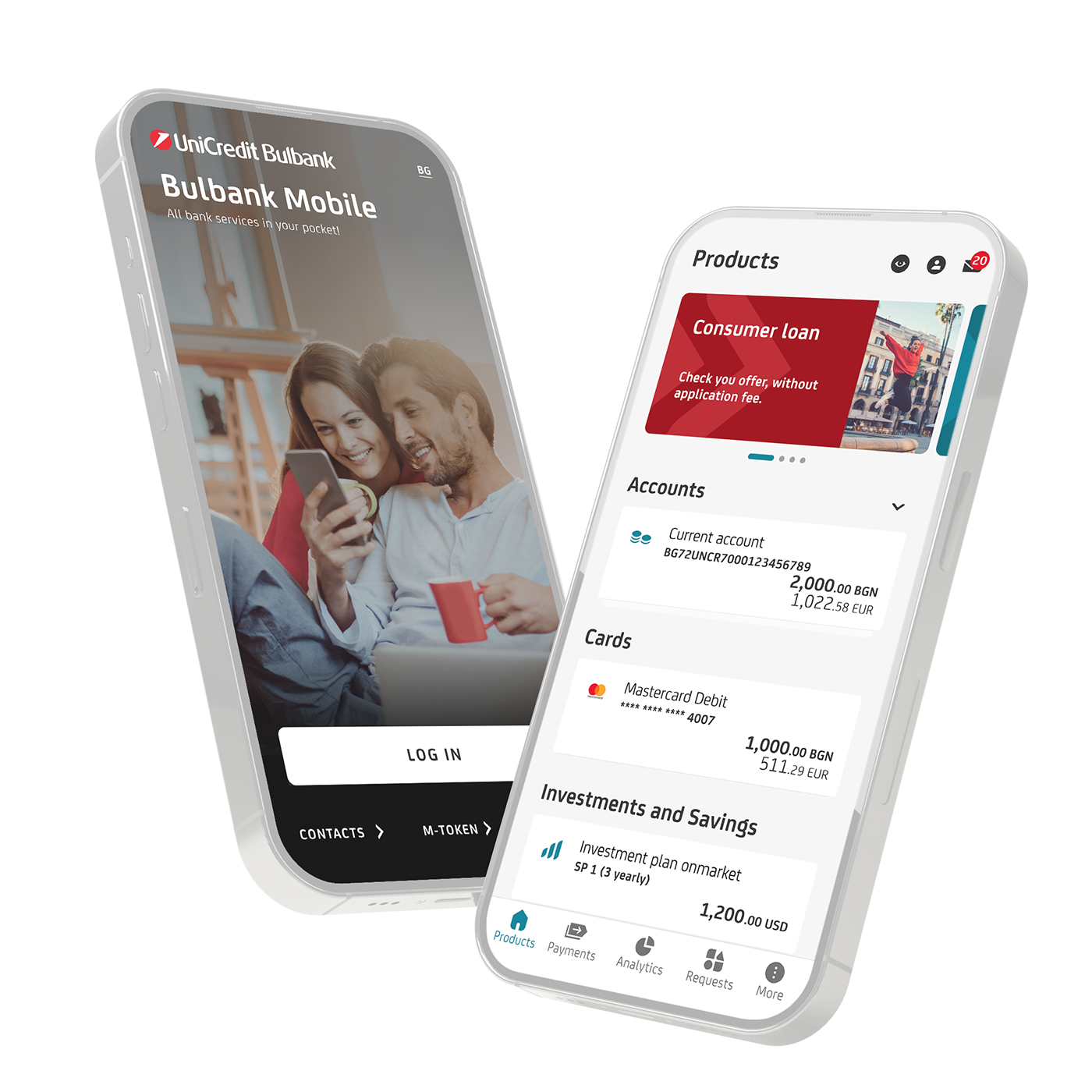

You can now get your bank card delivered to your home, office or other convenient address in Bulgaria and activate it with an E-PIN in Bulbank Mobile.