Advantages

- You receive additional pension income independent of the state system, as well as the opportunity for early retirement

- You determine the amount, date and frequency of the contributions (monthly, quarterly, six-monthly, annual, or single)

- Withdrawal flexibility you can withdraw the funds as a lump sum, in contributions or in the form of a monthly pension

- Tax relief the funds received after retirement are exempted from tax

- Conclusion entirely online through the Bulbank Mobile application

- Online access to the account you monitor in real time how your funds are developing

Characteristics

Types of contributions

Icon- Voluntary insurance is made with personal contributions, contributions from an employer or another insurer.

- There are no restrictions on the personal contributions amount, while the amount of the future pension depends primarily on the contributions made.

Investment portfolio

Icon- The portfolio is diversified, aiming for stable income and risk control.

- Invested in debt and equity securities, as well as deposits and cash.

Access to the funds at any time

Icon

- Insured persons personally choose how to receive their funds – as a fixed-term or lifelong pension under an individual plan, or as a lump sum.

- The funds are tax-free and subject to inheriting.

- The amounts accumulated in the voluntary pension fund are not subject to taxes and may be inherited by persons designated by you in advance.

Frequently asked questions

This is a form of supplementary pension insurance where you choose to make contributions to your future pension, regardless of mandatory social security insurance.

Voluntary insurance is made with personal contributions, contributions from an employer or another insurer.

The amount and frequency of the contributions are determined by the customer – monthly, quarterly, six-monthly, annual, or single

Insured persons are entitled to a tax relief of up to 10% of the annual tax base for such personal contributions.

For tax purposes, the full amount of employer/insurer contributions to additional voluntary insurance is recognized. Their amount reduces the company's annual result and is subject to tax on expenses.

Employers'/insurers' contributions to additional voluntary pension insurance of up to EUR 30.67 per month per employed person are exempt from tax on expenses.

The individuals may withdraw funds from their account without restrictions, terminate or temporarily suspend the contributions without penalties, fines and interest, change the amount of the contribution and the frequency of its payment at any time and without restrictions.

All accumulated funds are inherited by the legal heirs of the insured individual or by beneficiaries previously designated by the insured.

The individuals insured in the Allianz Bulgaria Voluntarily Pension Fund who have acquired the right to a pension may choose between different types of payments:

- Old age and disability pensions – fixed-term or lifelong

- Withdrawals under an individual plan determined by the pensioner

- Single repayment of the funds

Voluntary pension insurance is flexible and can meet your business needs. Learn how you can insure your employees and how will you benefit from this.

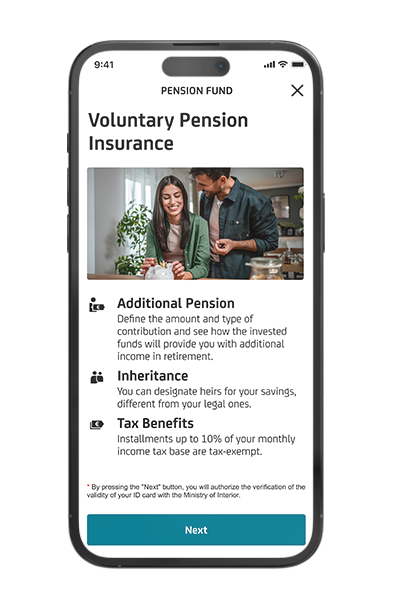

Digital process

If you are a UniCredit Bulbank’s customer, you may conclude a contract for voluntary insurance with personal contributions completely online through our Bulbank Mobile application.

- Log in to Bulbank Mobile and select the "Offers" > "Invesments and Savings" > "Voluntary Pension Fund"

- Learn about the benefits from the Voluntary Pension Fund and plan your desired pension.

- Determine the amount and type of contribution and calculate your additional retirement income

- Answer a few questions about your employment

- Get acquainted with the documents and sign them electronically

If you need additional assistance, do not hesitate to visit a UniCredit Bulbank branch convenient for you.