Investment plan

What is a onemarkets Fund investment plan?

- An investment plan is a modern solution for anyone who wants to set aside funds for a specific goal – a trip, a new car, your children’s education, etc.

- Invest small amounts on a regular basis in onemarkets Fund mutual funds backed by the largest asset management companies in the world. The longer the investment period, the greater the potential for returns.

- Tailored solution to match your client’s profile with a wide choice of investment funds.

What are the advantages?

Payment

IconYou can determine the date and amount of your contribution and you can use the accumulated funds in a tamely manner after selling the respective units.

Transfer

IconAutomatic transfer from your personal account.

Returns

IconReturns on investments in mutual funds are not taxable in Bulgaria in accordance to applicable legislation.

Bulbank Mobile

IconYou can check the current status of your investments plan using Bulbank Mobile.

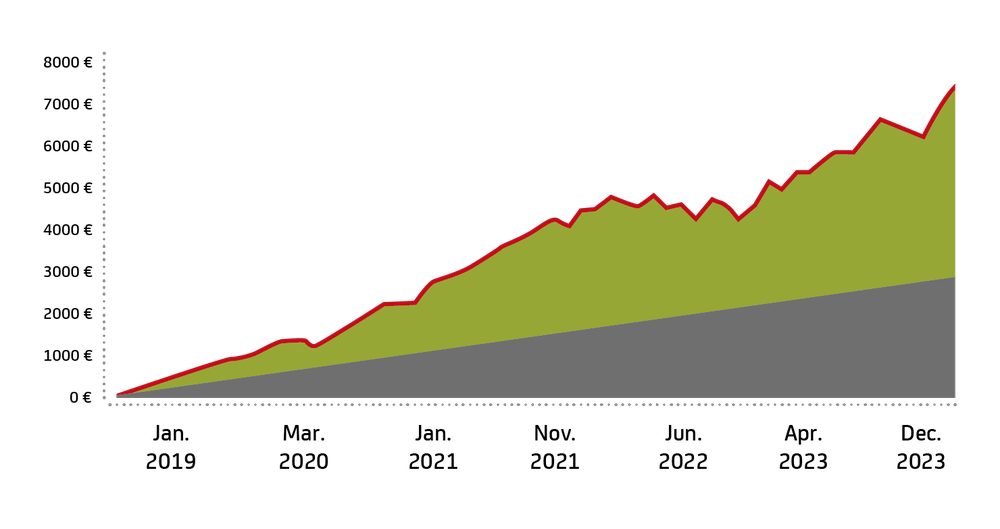

Example

*The diagram presents a simulation of an investment with MSCI World on the basis of actual historical data for the period of January 2019 to December 2023 with a monthly contribution of EUR 50. At the end of the period the investor would have EUR 3,626. The amount indicated at the end of the period does not include an one-off entrance fee in the amount of EUR 50.70 for the specific investment.

* Past performance of the Funds is not related by necessity to future performance from these activities. The value of investments and related income may go up but may also go down with no guarantee of profit and there is a risk that the investors may not recover full amount of their investment. The information is provided for illustrative purposes only and it does not constitute advice on dealing in financial instruments. Each investor is deemed to make his/her own decision to invest and/or enter into other transactions in units in Funds. UniCredit Bulbank AD does not provide an investment advice.

Concluding an investment plan

If you are a customer of UniCredit Bulbank you can conclude the investment plan digitally via our mobile app Bulbank Mobile:

- Log in to Bulbank Mobile and open the menu “Investments”;

- Explore the available opportunities and choose the strategy that best meets your goals;

- Carefully become familiar with all documents and confirm;

- Answer several brief questions on your experience with and knowledge of financial instruments;

- Select the investment plan parameters, review the relevant documents and sign them digitally.

If you need further assistance, do not hesitate to visit a convenient branch of UniCredit Bulbank AD.

Frequently Asked Questions

The investment plan allows for automatic regular monthly investments from your account at the bank in a mutual fund of your choice, with an installment and date of your choice. The investment plan makes it possible to achieve profitability by purchasing shares at a different price.

Mutual funds are the most widely used form of saving and investing in the world. Investors have access to the global financial markets and the companies involved in them. Among the main advantages of mutual funds are:

- transparency and professional investment management;

- risk diversification;

- access to your funds when needed.

At UniCredit Bulbank, we offer a wide range of investment funds with different strategy, risk level and recommended horizon, according to the risk profile and the investor's goals:

- Equity funds – with the potential for higher returns under dynamic market conditions.

- Mixed funds – a balanced approach through a combination of mainly stocks and bonds.

- Bond funds – providing more stable returns with a lower level of risk.

- Money market funds – providing high liquidity and low volatility.

The minimum installment for an investment plan is 20 EUR/USD.

A one-time entry fee, which is calculated as a percentage of the total amount of installments under the investment plan for the first 60 months and is due in advance together with the first monthly installment.

Annual costs, calculated in the price per share on a daily basis, after which the so-called "share price" is formed. NAV (net asset value).

Each fund has a recommended investment horizon determined based on the fund's investment strategy, characteristics, risk and returns. You can buy back your investment at any time or hold it for a longer period.

This is part of the product's flexibility. You do not owe fees and penalties for missing an installment. The system automatically searches for the specified amount on the specified account within 3 business days, after which it skips the current month.

It is important to know that if 6 consecutive monthly installments are missed, the investment plan is automatically terminated.

The changes that can be made under the investment plan are: the date of the installment (from the 1st to the 28th day of the month) and the service account from which the monthly installments are deducted.

MY SAVINGS

Regardless of the stage of life you are in, saving money always seems a good idea. Here are some tried-and-tested practices for faster and easier keeping of a savings account.