Customer care regarding Covid-19

Banking during COVID 19:

Frequently asked questions

The health and well-being of you, our customers and of our colleagues is our top priority. To ensure our services and operations remain available as usual without disruption we have put in place precautionary measures at our offices and branches. Our policies and procedures are in line with the heath authorities recommendations and the World Health Organization.

The bank continues to actively monitor the situation, always act in everyone’s best interest and do the right thing!

Up to date information with the working branches is available oн the web site here, as well as the ATM network. Following the recommendations of the health authorities, we advise you to visit branches only if it is absolutely needed. In these cases, for your protection, please follow the required distance of 2 meters between you and the other people. We remind you that wearing a mask to cover the area around the mouth and nose is mandatory.

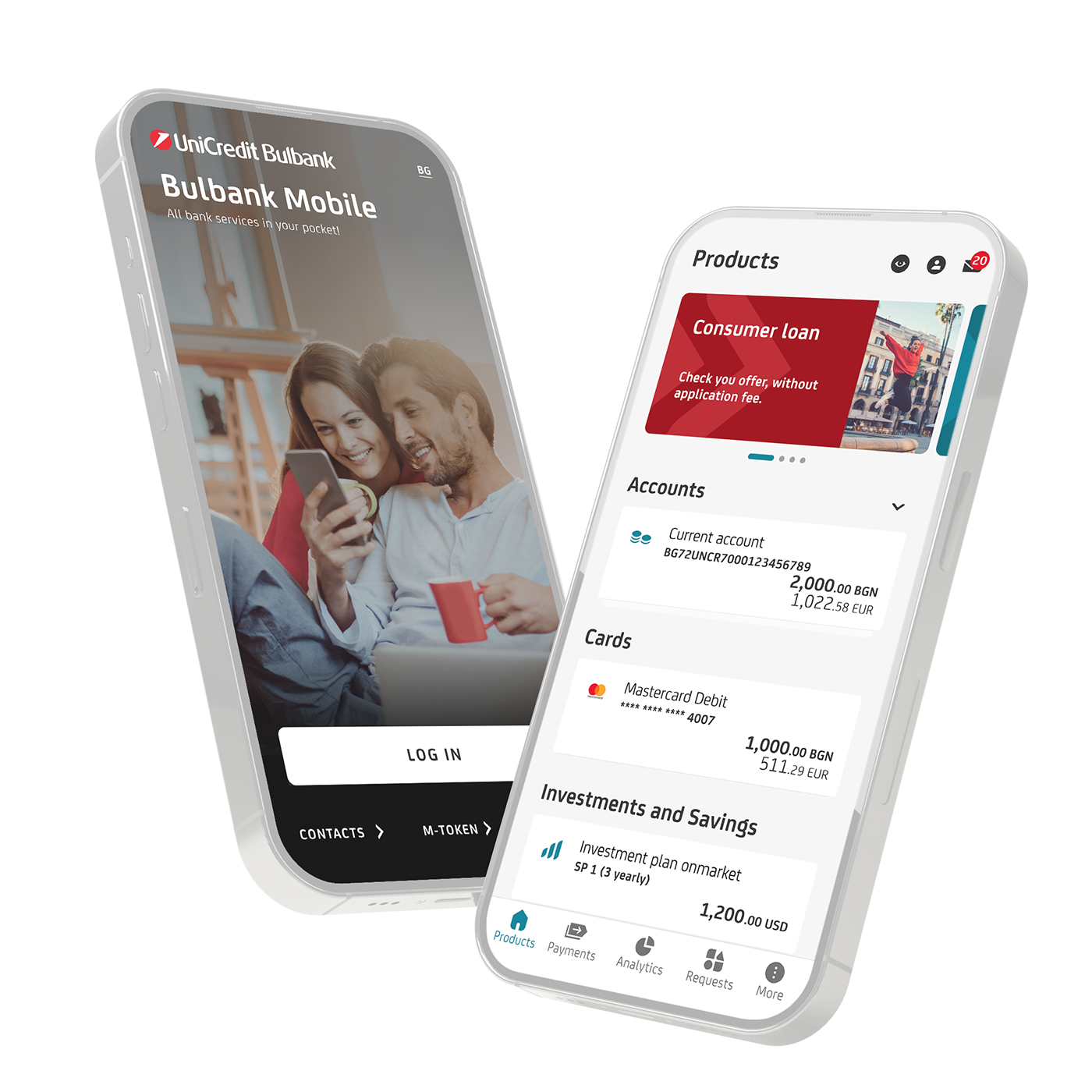

Important! If you want to receive information related to your loan, to make a transfer or to check incoming transfers or the money in your account, there is no need to visit a branch. You can do all of these and many more, if you use the mobile banking app Bulbank Mobile.

The health and well-being of you, our customers and of our colleagues is our top priority. Changes in the working time of some locations gives us opportunity to assure additional cleaning and disinfection is regularly performed in the locations. In addition we have split the teams in such a way that allows us to service you, while at the same time we contribute to the limitation of the spread of COVID-19.

If a branch needs to be closed for full disinfection, the clients might be temporarily advised to use another nearby location.

To ensure our services and operations remain available as usual without disruption we have put in place precautionary measures at our offices and branches. Our policies and procedures are in line with the heath authorities recommendations and the guidance provided by the World Health Organization.

- All frontline employees at the branches are provided with protective masks, gloves and disinfectants and instructions for their proper use;

- In the branches additional cleaning and disinfection is carried out;

- In some locations we have provided additional safety glasses between clients and colleagues and continue to deliver new ones to the network.

- The limit of the contactless payments without requirement for PIN has been increased from BGN 50 to BGN 100. Thus in 9 out of 10 payments the clients will avoid touching the POS terminal.

- Unicredit Bulbank customers can also pay at POS terminals with a mobile device via Digital Wallet and Apple Pay.

- We recommend that clients and colleagues observe the distance of 2 meters according to the guidelines of the health authorities.

- We remind you that when visiting an affiliate, customers must wear a mask to cover their nose and mouth..

- UniCredit Bulbank clients can retrieve all relevant information on products and services and perform all main banking activities in a simple, fast and secure way through our following digital channels: Internet Banking, Mobile Banking, ATMs and Customer Contact Center.

- With the exception of our front-line colleagues at the branches, the bank has enabled many people to work from home, thereby reducing the chance of spread of COVID-19 without compromising on quality of banking service, etc.

What measures would you take if an employee is COVID-19 positive?

We have a very clear protocol in this case, which aims to protect the health of clients and employees and to limit the spread of the virus. With a positive COVID-19 test, we strictly follow the recommendations of the health authorities and the colleague would be quarantined in accordance with the requirements of the Regional Health Inspectorates. As a precautionary measure, the location in which he has worked is subject to immediate closure, cleaning and complete disinfection. In the case of colleague, working in a branch, the customers of that branch may be temporarily directed to another nearby location. The Bank is committed to recommend immediate quarantine to all customers or employees with whom the colleague has had direct contact. The branch can be reopened only after complete disinfection and with a team that has not been in direct contact with the positive colleague.. As a precaution against the virus, the bank employees wear masks and gloves, use disinfectants, observe the recommended distance, etc.

If we were notified that a person who tested positive for COVID-19 had visited our office or branch, we would apply all the measures described above as if our employee became ill.

No, you should not. The activation of Bulbank Mobile is entirely mobile. No need to visit a branch. You have only to complete the following steps:

- Download and install in your phone the app Bulbank Mobile from your app store.

- Enter in the app and chose the option “Become a customer”.

- Fill in the short template that will appear on the screen. An operator from Customer Contact Center will call you as soon as possible to finalize the activation.

Call directly 15 333 from your mobile to receive the nessessary assistance to activate the service.

You can do this without visiting a branch or calling the Customer Contact Center.. Through Bulbank mobile you can check if a transaction has been done with your debit card, even it is used for payment the very same day. How you can do that? Log in to your Bulbank Mobile and then go to Cards Menu. Then select the card that with which you made the payment. Information about the transactions will be displayed on the screen.

Full information with news, current offers for support to the clients and the real business, with information about the bank network, etc. is available on the bank website www.unicreditbulbank.bg.

On the web site one can also inform about up-to-date information, innovative digital solutions and new products.

In the bank's blog you can see how to teach children financial literacy, why it is good to pay by phone and etc.

By calling the Customer Contact Center on 0700 1 84 84 or 1 84 84 from mobile phone all customers could:

- Get additional information about the cards, credits, accounts and savings you use;

- Receive after-sales assistance for all your products and services;

- Apply for a credit remotely, request a new bank card or account;

- Activate mobile banking and many more;

We are constantly in close contact with our colleagues via many internal communication channels and we provide them regularly with current news.

Yes! UniCredit is a solid bank with a strong balance sheet, committed to serving its customers and supporting the real economy in all geographies where we operate. As usual, you have access to your money via ATMs and in the branches. For transactions we recommend to use the digital channels, when possible. However, the safest place for your money is your UniCredit’s bank account.

Important information