• The Group analyzers expect positive GDP growth yet at the end of this year

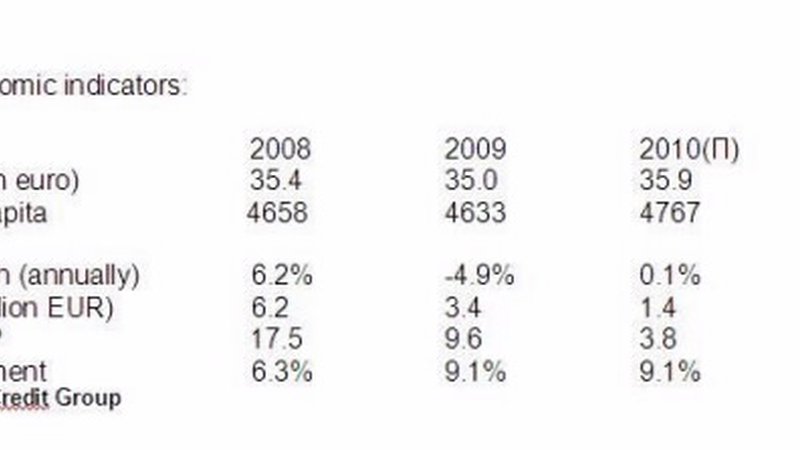

The growth prospects for the Bulgarian economy have been improving in recent months, which will lead to positive GDP growth yet at the end of this year. This is the forecast of UniCredit analyzers from their last economic report on the economy of Central and Eastern Europe (CEE). In particular for Bulgaria, the last forecasts of the economic experts of UniCredit promise that the country will close this year with growth of 0.1% and at the end of 2011 the indicator will be 2.8%.

This increase by 0.6 percentage points both for 2010 and for 2011, is due to the indications for stabilizing the investments from the last months, while at the same time the industry has started to open working places again.

Still below the potential

“Nonetheless, the probability for the economic growth to reach its potential (evaluated to approximately 4% annually) before the middle of 2012 is still small” – the analysis indicates. As a reason for this adjustments on the labour market in some domestic demand-oriented sectors were stated, which weighs on the pace of recovery of the individual consumption.

„The delayed structural reforms are most likely to hold back the pace of recovery of the investments and the employment. What probably is the most important circumstance, is that some investors seem confident that the toughest tests for the Greek recovery still lie ahead. This affects both the inflow of foreign capital and debt servicing costs for the Bulgarian economy”, Christofor Pavlov, Chief Economist of UniCredit Bulbank, explained.

The third quarter brought industry and export recovery

The pace of recovery of GDP in the last quarter of 2010 has grown to 0.7% for the quarter, in this way the GDP annual growth has become again on the positive (0.5% for the third quarter) after five quarters in a row with negative values. The export is also speeding up.

“In our opinion, this impressive result reflects mostly the stable recovery of the industry competitiveness”, the economists of UniCredit have stated in their regular report, drawing the interesting conclusion that in the third quarter of 2010 the GVA (gross value added) for one working hour in the industry has reached the impressive value of 13% over the levels which it had two years ago, when the crisis began. As further confirmation of the recovery of the Bulgarian industrial sector they see the improving of the business confidence index, which in November went up to -7 points, considerably above the bottom of -15, reached in August 2009 and getting near to its 10-year average value of -1 points.

Data on domestic demand-oriented sectors are not so optimistic

While the employment in the export-led sectors improves, moving roughly a third of the economy out of the red zone, the data on domestic demand-oriented sectors are less encouraging.

„The drop of the individual consumption has sharpened during the last quarter (-2.6% per a quarter and -5.9% per a year), underlying the fact that the household sector needs more time before joining the process of recovery”, Christofor Pavlov thinks. In his opinion the improving of the employment during the second quarter of the year is due to seasonal factors and the slight household credit growth, combined with the high savings rate are further indications to show that the households have not still felt sufficiently secure regarding the prospects they face.

Besides, the indicators of the expectations to the trade and construction sectors – two sectors oriented mostly to the domestic consumption, preserve their low values, despite the slight improving from the last several months, which shows that the difficult rebalancing of these sectors is still in place and will still be for some time.

All this shows that the impressive recovery of the export will not be sufficient to rescue the rest of the economy with individual consumption turning into the Achilles heel of the Bulgarian recovery, the analysis of UniCredit summarizes.

The good news

The flow of news related to the investments has improved, showing that the growth drivers will increase with another one as of 2011. Therefore the expectations of the analyzers of UniCredit regarding the investments is that they will start to report positive contribution to the GDP growth, in this way making the process of the economic recovery more widely based.

Strengths:

• Recovered export competitiveness;

• Low public debt;

• Improved utilization of EU funds.

Weaknesses:

• High private corporate debt;

• Great vulnerability to the threats generated by the economic problems of Greece;

• Limited space to maneuver (from the point of view of the economic policy) in case of new external cataclysm.