CEE will gain from the global recovery, however concerns about fiscal imbalances and lending remain

The projections for the development of the economies of the countries improve although it is early to talk about euphoria, UniCredit Group’s economists point out in their latest quarterly report for Central and Eastern Europe. The economies of the countries in the region remain vulnerable, but, if prior to the crisis their weaknesses were related mainly to their dependence on external financing now the greatest uncertainty about their further development comes from the fiscal imbalances, the economists think.

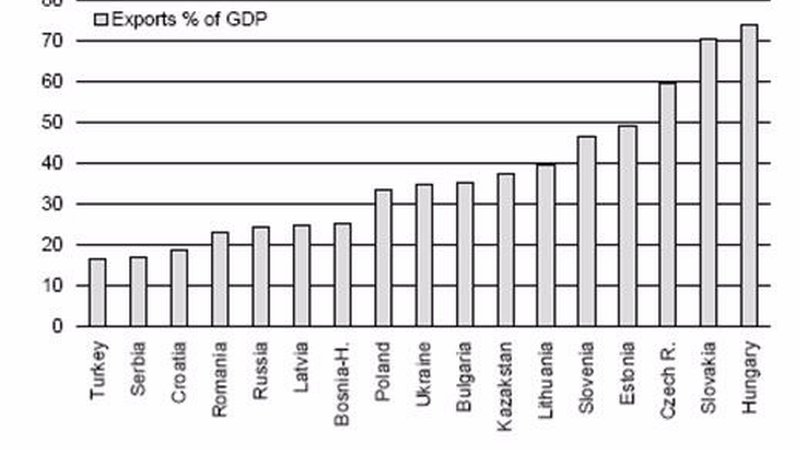

Central and Eastern Europe (CEE) will win from the comparatively fast recovery of the economies of the countries in the Eurozone. The beneficial effect of the Western economic conditions looking up will be felt by the countries with open economies – the Czech Republic, Hungary and Slovakia.

In some countries, however, the fiscal imbalances remain a hot topic. In Kazakhstan and Russia, for example, deficits become bigger and bigger due to reduction of the prices of natural resources despite the positive impact of the low public debt levels (the expectations for the end of 2009 are for 4.4% from the GDP in Russia and 11.3% in Kazakhstan).

The expected recovery will put an end to the current tendency of reduction of the interest rate levels as an anti-crisis measure: Turkey, Hungary and Russia are the only countries in which UniCredit analysts expect new drops of the base interest rate by the end of 2009.

Positive signals are coming from the banking sector in the region as well. In the first place, the recovery of the assets prices made IMF reduce its forcasts on the losses of the financial sector. In addition the expectations of UniCredit’s economists are for reduction of the bad loans forecasts due to improvement of the economic conditions. “No average figure can be given for the non-performing loans for the region because in the various countries they vary in broad ranges, the methodology by which they are classified as bad also differs. It is clear that at the end of 2009 and in the beginning of 2010 we will see the peak of bad loans”, said Debora Revoltela, who is in charge of CEE strategic analyses in UniCredit Group. She thinks that banks will manage to cope with the increased bad loans using the existing capital reserves which will additionally be positively impacted by the expected decrease in the price of the risk in 2010. Another positive signal coming from the banking sector is the enhancing of the capital positions of certain banks which is an indication of their readiness to lend.

CEE will ride out of the crisis with a changed economic growth structure in favour of net exports. In this way the deficit on the current account – the principal weakness of most countries in the region will be offset.

UniCredit analysts expect increase in export share of GDP: