• The automotive sector was among the most affected by the financial crisis in 2009. World production decreased for the second year in a row: in 2009, production of motor vehicles dropped by almost 10mn units, according to the recently released data from the OICA, International Organization of Motor Vehicle Manufacturers.

• Automotive is the most important sector for CEE economies. CEE countries suffered a drop in production of half a million vehicles (-12%), but the region was able to increase its share in total European production, despite the sharper impact of the crisis on their economies. During the past decade the share of vehicles produced in CEE out of the total European production jumped from 9% in 1999 to 22.4% in 2008 and moved further up to 24% in 2009. The crisis accentuated the speed of the restructuring of the sector, and the West-East substitution of production continued.

• Russia and Ukraine were an exception: their economies were particularly affected by the crisis in 2009 and because their automotive sector is less efficient and less export-oriented, automotive production in both countries collapsed, with the result that production plunged by 1.5mn units to only 800,000 vehicles.

• Paradoxically, despite the automotive sector is characterized by huge spare capacity, many OEMs are still expanding their capacity in CEE (Fiat in Serbia, Mercedes in Hungary, VW in Slovakia, Bosch moving from Wales to Hungary, Renault and Toyota investing in Turkey, etc.). These trends bode well for the future of the sector in CEE.

2009 – A tough year for the automotive sector

Last year, 61mn vehicles – including passenger cars and commercial vehicles – were produced at world level, significantly down from 70.5mn in 2008 (-13.5%), according to the International Organization of Motor Vehicle Manufacturers (OICA), which recently released the data of motor vehicle production for the full-year 2009. Passenger cars’ production dropped by 10%, to 47.2mn, at world level. These results were positively affected by the performance of emerging markets and negatively influenced by the performance of the more mature markets, namely US, Japan, and Western Europe. The more developed countries produced 10mn fewer vehicles in 2009 – indeed a huge amount - with respect to 2008. Specifically, Western Europe was affected by a drop of 3mn units in production, -20% with respect to 2008.

Last year saw the continuation of some global trends in the sector:

• World production decreased for the second year in a row. The 3.7% drop in 2008 was followed, at world level, by the 13.5% drop in 2009 (following numerous years in a row of positive growth, + 4.5% on average in 2002-2007).

• The US producers continued to be the worst hit and this has had the catastrophic effect of the manufacturing industry suffering one of the largest mass lay-offs in its history worldwide. Among the Detroit’s big three, GM and Chrysler got massive subsidies and support (USD 62bn) from the US taxpayer. Chrysler was taken over by Italian Fiat. In summary, Ford, despite the troubles, was the only one among the three to avoid bankruptcy and having to take government loans.

• The well-known structural problems of overcapacity, saturation and weak demand continued, and were even exacerbated: demand was constantly weakening, not only because of the fluctuations of the economic cycle, but because traditional markets (especially in the US and Western Europe) were already saturated and are no longer offering significant growth prospects.

• Тhe increased sensitivity to global warming and greenhouse emissions has continued to push customers to change their preference in favor of smaller and more fuel-efficient vehicles during the past years; the effects of the economic crisis were pushing in the same direction, in favor of smaller cars.

• Acquisitions and partnerships were among the strategies implemented by the OEMs (Original Equipment Manufacturers i.e. car producers) to survive the tough environment: e.g. (a) Italian Fiat, as mentioned, took over American Chrysler: in January 2009, Fiat signed the agreement to take a stake in Chrysler out of a US-government funded bankruptcy; (b) German Opel, owned by GM, was put on sale; (c) at the end of 2009, Volkswagen and Suzuki announced their global partnership: the two companies are to become the world leader in terms of production, surpassing Japanese Toyota; (d) in March 2010, Ford announced is intention to sell Swedish Volvo to the Zhejiang Geely Holding, which owns the Chinese carmaker Geely; (e) in April 2010, Daimler agreed to swap 3% equity stakes with Renault-Nissan (in turn, Renault owns 44% of Nissan, which owns 15% of the French carmaker).

• The role of emerging markets continued to develop, driven by the stellar performance of the Chinese production (+48%, from 9.3mn to 13.8mn vehicles in 2009). The relocation of production to emerging markets even accelerated during the crisis in some cases. On the whole, emerging markets contributed to an increase of production of 900,000 vehicles in 2009, while developed markets posted, in terms of production, a decrease of more than 10.4mn vehicles, as mentioned. Emerging markets have already contributed to an impressive increase of production of 19.5mn vehicles during the past decade (1999-2009), 12mn of which are attributed to China. The year 2009 marks the first year in which emerging markets production overtook production from North America, Japan and Western Europe (it was slightly higher than 20% a decade ago and is now at 55%).

• For the first time in its history, in 2009 China surpassed Japan as the first world producers of motor vehicles in the world. Chinese production reached 13.8m vehicles, of which 10.4mn passenger cars and 3.4mn commercial vehicles.

Automotive – A big deal in CEE

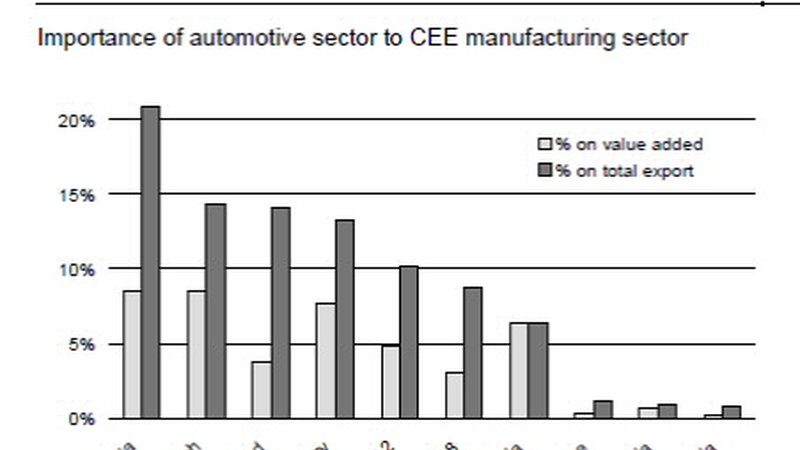

The automotive sector, as mentioned one of the most affected during the crisis at world level, is the most important manufacturing sector for most of the Central Eastern European (CEE) economies. For Slovakia, the Czech Republic, Poland and Hungary the sector represents a large share of manufacturing value added and export (more than 20% of Slovakian manufacturing exports, for instance, and around 15% for the other CEE countries).

Regarding the performance of the sector in CEE, two main pieces of information must be considered: #1 the economies of the region were among the most affected during the global financial crisis of 2009 (for example: three-fourths of IMF support during the crisis were devoted to CEE), and local demand dropped sharply – all in all, vehicle production in the region fell by 12% in 2009; #2 despite this, during 2009 CEE countries continued to erode the share of vehicle production of Western European countries. In one decade the share of motor vehicles (passenger car and commercial vehicles) produced in CEE out of the total European production jumped from 9% (in 1999, including Turkey) to 22.4% in 2008 and moved further to 24% in 2009. Still, this ratio is sensibly lower than the ratio of emerging markets production on world production. If we add Russia and Ukraine, production beyond the former “iron curtain” reached 28% of the total in 2009. Among the world countries with the best performance in 2009 – in the midst of the crisis – are Romania, Slovenia, the Czech Republic (all these three with positive growth in terms of production), Poland and Serbia.

Russia and Ukraine were an exception, given their economies were more affected by the crisis: their GDP dropped by 7.9% and 15.1%, respectively, and production of motor vehicles more than halved. The collapse totaled a drop in production of 1.5mn units to only 800,000 vehicles. Production in Uzbekistan almost halved.

In summary, the automotive sector of CEE countries fared better than Western Europe, despite the pressures of Western governments on producers to maintain production in the home country and avoid further pressures on employment levels during the toughest period of the crisis. The West - East substitution of production clearly continued, despite a two-speed evolution could clearly be seen: on one side, the strength of Central European countries, on the other, the weakness of the sector in Ukraine and Russia.

The results can be explained by different factors: #1 optimization of production by OEMs: production in the East is more efficient – amidst lower costs and, in many cases, more recent and modern factories – and hence there is an incentive to reduce production in Western Europe rather than in Eastern Europe; pressures on labor cost, whose increase were one of the main concerns in the pre-crisis environment, eased sensibly: Eastern European competitiveness on costs is higher now in comparison with some years ago; #2 All the top 10 automotive players in the world – they represent almost 80% of global production, as the sector is very concentrated – already have plants in CEE and are still betting on this area for their future development; the same is true for the top 10 automotive suppliers, all with factories

in the region; #3 CEE countries are more devoted to the production of smaller cars (whose production is more labor-intensive), such as the Fiat Panda and the Fiat 500 in Poland, the Toyota Aygo, the Citroen C1, or Peugeot 106 in the Czech Republic, Renault Twingo in Slovenia, the Logan in Romania and several others (despite some SUVs and luxury cars now being produced in the region in 2006-09 by VW, Audi, Porsche). These models were favored by consumers during the crisis, because they are cheaper and because the scrap incentives were, in some cases, more relevant given the lower pollution emissions of smaller cars.

We believe the above factors will remain in place, at least partially, during the next years even if the crisis fades, and this will bode well for the role of automotive production in the region. Paradoxically, on one hand, the automotive sector is characterized by a huge (and increased) spare capacity at world level, estimated at 35%-40% in 2009, jumping from around 20% in 2007; on the other, many OEMs are expanding their production capacity in Eastern Europe.

Among the most relevant examples:

(a) Italian Fiat, whose Polish factory produced at full steam even during the crisis thanks to the success of the small models Panda and 500 (benefiting from the scrap incentives in Germany and Italy), is expanding in Serbia, where it established a joint venture with the Serbian government (67% Fiat, 33% Serbian government) and took over the Zastava factory in Kragujevac, which was previously producing few cars under Fiat license. In a few years, Fiat exports from Serbia will likely represent one fifth of total Serbian exports.

(b) Mercedes invested EUR 800mn in a new plant in Kecskemét (Hungary). The company is building the factory and in 2011-12 is to start production of Class A and Class B models (2,500 workers to be employed): annual production capacity to reach 100,000 compact Mercedes cars in 2012 and 150,000 units in 2013.

(c) In Slovakia, Volkswagen is to produce a new line of small-sized family cars in 2011. This should create 1,500 direct jobs and the production capacity will be expanded up to 400,000 vehicles after the production line is put into full operations. In 2009, around 188,000 vehicles were produced.

(d) Bosch is closing its plant in Glamorgan (Wales) in summer 2011, with 900 people to be laid off, and is moving to Hungary. Labor costs in Hungary are at 65% of the plant in Wales.

(e) Toyota is shifting back the production of the new Corolla model vehicle to Turkey in 2012. Between 1995 and 2006, around 300,000 cars were produced in Adapazari before the production of Corollas was moved to South Africa and Japan in 2007.

(f) Renault chose its Bursa plant, in Turkey, as the main production hub for its Clio model, despite the pressures from the French government. Renault plans to produce 280,000 units of the model annually from 2013. At the same time, it is considering stopping production in Spain and Slovenia sometime around 2013.

These trends confirm that CEE will further increase its role as production arm of Western Europe in the automotive sector. The “borderless economy” of Central Europe – in particular, Czech Republic, Slovakia, Hungary – will remain one of the most important clusters for the main OEMs and their suppliers, not only from Western Europe but also from Asia (Toyota, Suzuki, KIA, Hyunday, Honda have factories in CEE). Slovakia, the Czech Republic and Slovenia remain the countries in the world that produce more vehicles in relation to the size of their population.